Employee payroll giving is a powerful yet often underutilized tool for nonprofit fundraising. By allowing employees to donate a portion of their salary directly to charity, this method not only simplifies the giving process but also fosters a culture of philanthropy within the workplace.

For fundraisers, understanding and leveraging payroll giving programs can open up a steady stream of donations, build stronger relationships with corporate partners, and significantly enhance the impact of their campaigns.

In this guide, we’ll explore the ins and outs of employee payroll giving, from the basics to advanced strategies, helping you maximize the potential of this fundraising channel.

- What is Payroll Giving?

- Why Payroll Giving Matters

- How to Secure More Payroll Donations for Your Cause

- Employee Payroll Giving and Corporate Matching Gifts

Let’s begin!

What is Payroll Giving?

Payroll giving is a type of workplace giving program that allows employees to donate a portion of their pre-tax salary directly to a nonprofit organization of their choice. The donation is automatically deducted from the employee’s paycheck, making the process seamless and convenient. Because the contributions are made from pre-tax income, employees can give more to their chosen cause without feeling a significant impact on their take-home pay.

Payroll giving is a popular method for fostering a culture of philanthropy within companies, as it provides a simple, consistent way for employees to support the causes they care about while also allowing companies to demonstrate their commitment to corporate social responsibility (CSR).

Payroll Giving vs. Recurring Gifts

You might be thinking that payroll giving sounds a lot like another key form of nonprofit support: recurring gifts. And it’s true that payroll giving and other types of recurring donations share key similarities, as each provides a consistent and convenient way for donors to support their chosen causes over time. They both enable donors to contribute regularly, which helps nonprofits maintain a steady flow of funds and allows for sustained impact.

However, there are notable differences between the two. Payroll giving involves deductions directly from an employee’s pre-tax salary, requiring employer involvement in administering the program. In contrast, regular recurring donations are made independently from an individual’s after-tax income using methods such as bank account transfers or credit card payments.

Why Payroll Giving Matters

Payroll giving programs can have a big impact on each party involved—namely, the nonprofits that receive funds, the employees that contribute funding, and the companies that facilitate the giving. Let’s take a look at each one in detail below.

For Nonprofits

Payroll giving is crucial for nonprofits as it provides a reliable and predictable stream of income, enabling them to plan and execute their programs with greater financial stability. The consistency of these donations allows nonprofits to budget more effectively and reduce the time and resources spent on fundraising efforts.

Additionally, payroll giving often leads to higher donor retention rates, as the automatic nature of the contributions fosters long-term giving and deepens the relationship between donors and the nonprofit they support.

For Companies

Payroll giving is a valuable tool for companies to enhance their corporate social responsibility (CSR) efforts and foster a positive workplace culture. By offering payroll giving programs, companies demonstrate their commitment to philanthropy and social impact, which can improve their public image and strengthen their brand.

Moreover, these programs can increase employee engagement and satisfaction, as they allow employees to contribute to causes they care about easily and regularly.

For Employees

Payroll giving matters for employees because it provides a convenient and tax-efficient way to support the causes they are passionate about.

This method of giving also instills a sense of purpose and fulfillment, as employees see their employer supporting their charitable efforts. Furthermore, payroll giving simplifies the donation process, making it easier for employees to consistently contribute to charities, which can lead to greater personal satisfaction and a stronger connection to the causes they support.

How to Secure More Payroll Donations for Your Cause

Securing more support through payroll giving requires a strategic approach that engages both employees and their companies. Here’s how you can boost participation and maximize donations through payroll giving:

1. Inform donors about payroll giving opportunities.

First things first, it’s important to ensure that your supporter base is aware of the opportunity—and encouraged to enroll. For this, clear and consistent communication is key.

We recommend marketing payroll giving through a few key channels, which should include:

- Your website — Make sure to provide detailed information about payroll giving programs on your nonprofit or school’s main website. This should include a mention on your “Ways to Give” and/or “Workplace Giving” pages, too!

- Email blasts and newsletters — Regularly spotlight payroll giving as an easy and reliable way for donors to support your cause by including it in email newsletters. Link out to additional resources for donors to learn more and initiate payroll donations with ease.

- Social media — Post educational information about payroll giving programs on your organization’s social media pages. The more you demystify the opportunity, the more likely your followers will look into their own eligibility to get involved.

- Targeted outreach — If you know a donor works for a company with a payroll giving program, consider personally informing them about the opportunity with an email, letter, text message, or phone call.

By ensuring that donors are well-informed and understand the impact of their contributions, nonprofits and schools like yours can increase program participation and support.

2. Pre-register for companies’ CSR platforms.

Many companies use dedicated CSR platforms to manage their charitable activities, including payroll giving and other workplace giving programs. When their employees wish to initiate a donation directly from their paychecks, they’ll generally log into their employer’s dedicated portal, select a charity from a preapproved list, and configure their gift particulars.

In order for your organization to receive the most payroll donations possible, you must ensure your cause is included in companies’ approved charity lists. This not only increases visibility among potential new donors but also simplifies the process for existing supporters looking to set up their deductions. And the best thing you can do is register for these platforms with a free nonprofit account ahead of time.

Hint: For a headstart, check out the platform-specific tips for registering with top corporate giving systems in Double the Donation’s guide here.

3. Share payroll giving success stories to leverage social proof.

In any fundraising effort, sharing success stories is a powerful way to leverage social proof and encourage participation. When it comes to payroll giving, organizations can highlight the positive outcomes and real-world impact of payroll donations, providing compelling evidence of the program’s effectiveness.

Here are a few ways you might do so:

- Compelling testimonials from existing payroll giving donors about their experiences with the programs

- Powerful statistics, such as the number of payroll giving donors currently contributing to your cause

- Specific examples of projects or programs that have been funded, in part or in whole, through payroll giving funds

These stories can then be shared in newsletters, on social media, through your nonprofit website, and in other communications to showcase how contributions have made a difference in your mission overall. By illustrating the tangible benefits of payroll giving, organizations create a sense of connection and urgency, motivating more potential donors to get involved.

4. Build collaborative partnerships with payroll giving companies.

Finally, building collaborative partnerships with companies offering payroll giving programs can greatly enhance the effectiveness of your organization’s efforts. Doing so will allow you to create tailored campaigns and promotional materials that resonate with individual employees and build deeper connections with corporate leadership.

Collaborating closely with companies also allows organizations to receive valuable insights and feedback on how to engage employees most effectively. This approach not only boosts donations but also fosters long-term relationships that can lead to ongoing support and increased visibility.

Employee Payroll Giving and Corporate Matching Gifts

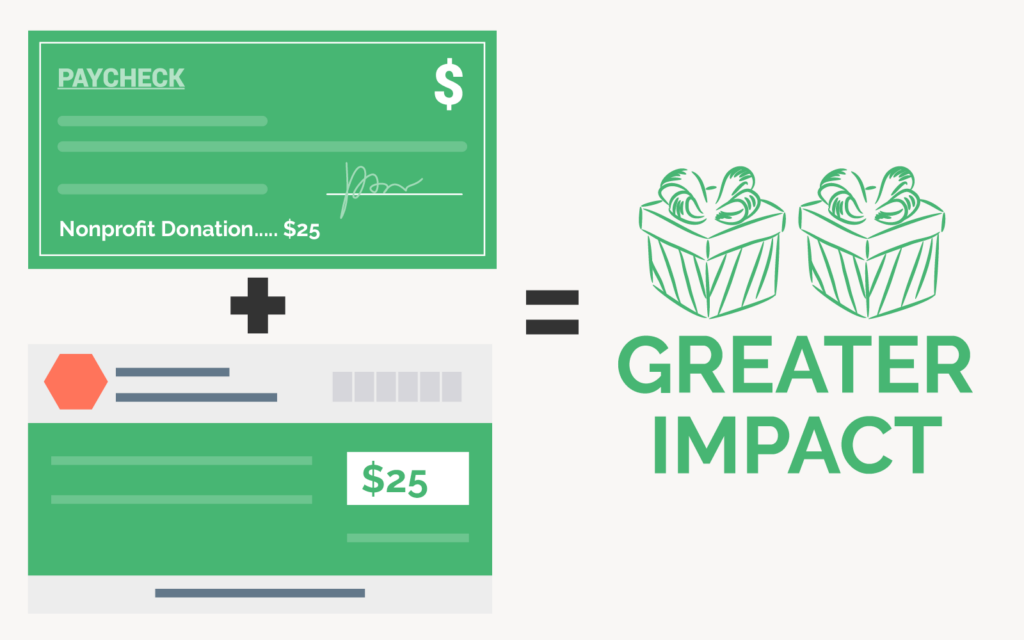

Across businesses of all shapes, sizes, and sectors, the most widely offered corporate giving programs include matching gifts and payroll giving. And the two types of initiatives often go hand in hand, with employees qualifying for both payroll giving and matching gifts.

Here, let’s explore these two programs and how they can best work together for causes like yours.

Employee Payroll Giving consists of employees contributing to nonprofit causes directly from their regular paychecks.

Corporate Matching Gifts, meanwhile, are programs where employers match the donations their employees make to eligible nonprofits, often doubling or even tripling the original donation.

This means that if an employee donates a certain amount through payroll giving, the employer will match that amount with its own gift to the organization, amplifying the impact of the initial contribution. Employees can give regularly through payroll deductions, and their donations are further increased by the company’s matching gift program.

For nonprofits, this relationship offers a substantial fundraising opportunity. By encouraging employees to participate in payroll giving and promoting awareness of corporate matching gift programs, nonprofits can maximize the donations they receive, turning each employee’s contribution into a more significant source of support for their cause. Additionally, this combination strengthens partnerships between companies and nonprofits, as both entities collaborate to achieve common social impact goals.

Wrapping Up & Further Reading

Employee payroll giving represents a win-win for everyone involved. Employees can effortlessly contribute to causes they care about. Employers can strengthen their corporate social responsibility efforts. Nonprofits can secure a consistent flow of funds.

By integrating payroll giving into your fundraising strategy, you can tap into this valuable resource, creating lasting partnerships with companies and their employees.

As you implement the strategies outlined in this guide, you’ll be well-equipped to make the most of payroll giving. Plus, drive greater impact for your cause and deepen engagement with your supporters.

Interested in learning more about top corporate giving strategies and opportunities? Check out our recommended reading:

- 50+ Popular Companies that Donate to Nonprofit Organizations. Get familiar with leading companies that support charitable causes like yours. This list includes payroll giving companies and more.

- Top Corporate Giving Facts & What They Mean for Nonprofits. Grow your knowledge about all things corporate giving with these must-know philanthropy facts. See how your organization can benefit!

- 8 Effective Strategies for Marketing Corporate Volunteerism. Volunteerism is another key form of corporate giving. Browse this guide to learn more about employee volunteering and how to get more support for your team.