Nonprofit professionals need to be crafty in how they secure fundraising revenue—their mission depends on it. Fortunately, with the rise of online fundraising campaigns for nonprofits, there are many ways for passionate advocates to connect with and contribute to causes they care about.

Plus, some corporations go the extra mile to support their employees’ social passions by investing in corporate giving efforts, which your nonprofit can leverage to boost your funding.

However, many companies don’t put significant effort into advertising their giving programs, so it’s up to your nonprofit to spread the word to your donors. Let’s go over some corporate giving facts that you can use to strengthen your outreach and encourage your donors to participate in their own employers’ programs.

What is corporate giving?

Corporate giving is the concept of corporations donating some of their revenue to charitable causes, sometimes to supplement their employees’ gifts.

There are several ways they can do so, such as:

- Sponsoring nonprofits

- Matching employee contributions

- Donating in-kind supplies

- Granting money based on hours volunteered

Corporate giving is best facilitated through workplace giving software, so it’s important for companies to choose their platforms carefully!

The corporate giving channels that require donor participation are volunteer grants and matching gifts, so we’ll be focusing on those two in this guide.

Why is corporate giving mutually beneficial?

You might be wondering why corporations give to nonprofits if they get nothing in return. Besides simply wanting to support a great cause, corporations can reap the following benefits from charitable activities, according to Nonprofits Source:

- Increase employee recruitment and engagement

- Reduce taxes

- Attract socially-minded customers

- Improve their reputation as a socially conscious company

Understanding the business benefits of philanthropic behavior can help your nonprofit craft pitches to corporations for their support. You may even inspire companies to start corporate giving programs from the ground up.

Top Corporate Giving Statistics to Know

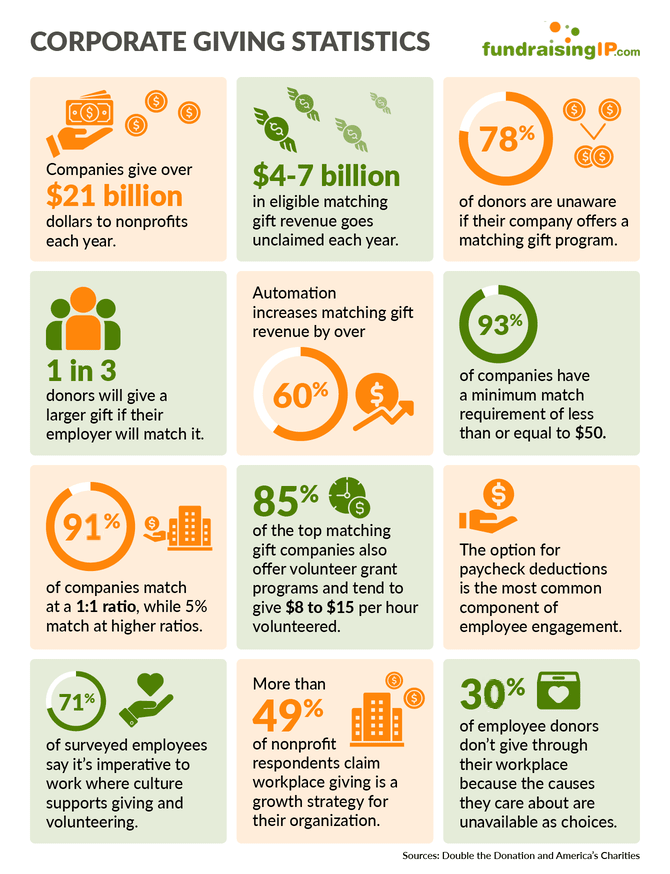

If you’re deciding whether it’s worth it to add corporate giving outreach to your plate, we’ve pulled together some compelling facts from Double the Donation’s corporate giving statistics, their recent matching gift facts, and America’s Charities’ workplace giving facts.

These corporate giving statistics communicate just how vital these programs are to the companies that offer them and the benefitting nonprofits:

- Companies give over $21 billion to nonprofits each year.

- $4-7 billion in eligible matching gift revenue goes unclaimed each year.

- 78% of donors are unaware if their company offers a matching gift program.

- 1 in 3 donors said that they’d give a larger gift if their employer matched it.

- Automation increases matching gift revenue by over 60%.

- 93% of companies have a minimum match requirement of less than or equal to $50.

- 91% of companies match at a 1:1 ratio, while 5% match at higher ratios.

- 85% of the top matching gift companies also offer volunteer grant programs and tend to give $8 to $15 per hour volunteered.

- Providing employees with an opportunity to make paycheck deductions is the most common component of employee engagement in workplace giving.

- 71% of surveyed employees say it’s imperative to work where culture is supportive of giving and volunteering.

- More than 49% of nonprofit respondents claim workplace giving is a growth strategy for their organization.

- 30% of employee donors say they don’t give through their workplace because the causes they care about are unavailable as choices in their employer’s giving program.

Drawing conclusions from corporate giving statistics like these can be challenging for nonprofits. To help, we’ll break it down into three main takeaways for nonprofits.

Raising donor awareness is crucial to securing gifts.

Statistics #3 and #4 highlight that corporate giving programs appeal to donors, but they often go unused simply due to a lack of awareness. It’s up to your organization to break the cycle and advertise the existence and advantages of corporate giving. You can do so by:

- Adding a matching gift call-to-action to your giving page. If your donor has already decided to give and has made their way to your giving page, it’s the perfect opportunity for you to educate them about matching gifts. Create a snappy and attention-grabbing call-to-action that explains how some companies can double (or even triple) a donation’s impact.

- Hosting a matching gifts and volunteer grants submission day. Giving days work so well because they infuse urgency into your cause and get your donors to give as soon as possible. Promoting and hosting a one-day matching gifts and volunteer grants campaign can encourage your donors to submit requests and be aware of their employers’ matching gift programs going forward.

- Creating a corporate giving information page on your website. Your nonprofit likely has a “ways to give” page already. This is a great place to inform donors about corporate giving opportunities, which companies in the area participate, and how to submit requests.

Ultimately, your donors trust your nonprofit and want to know more ways that they can contribute to your cause. Simply educating them about the impact of corporate giving can make a huge difference in securing larger donations.

Matching gift automation is key to preventing donation abandonment.

In addition to the general lack of knowledge about corporate giving, another factor contributing to unclaimed matching gifts is the involvement of the submission process. Most companies require employees to submit a form and their donation receipt to their corporate giving department before they donate, which can be complex and time-consuming for donors.

However, you can make the process more convenient and combat donation abandonment by using matching gift software. Matching gift submission software allows your donors to input their work email to see if their company offers matching gifts. Then, it provides donors with simple instructions for submitting their requests, taking most of the work out of the process for them.

When picking a matching gift software solution, prioritize the following features:

- Auto-submission. Take your matching gift automation to the next level with auto-submission, a feature that submits your donor’s matching gift request straight from your donation page to their employer with no extra steps.

- Integration with your donation page. Keeping your matching gift tool on the same page as your donation form prevents donors from accessing a new site, which is important for preserving data security and trust.

- CSV data importation. Having matching gift software that communicates with your CRM allows you to easily transfer donor information from one system to the other.

- Tiered pricing. If your nonprofit has a smaller budget or doesn’t require many capabilities, look for a solution that offers tiered pricing that corresponds to the features available.

While you research the matching gift platforms on the market, book free demos with those that match your budget and feature needs. Also, remember to pay attention to recent software reviews from nonprofits similar to yours so you can get an unbiased perspective.

Employees want choices for giving back.

Often, donors want to support causes in more than one way, and their employers can help them fulfill those desires. Work with your corporate partners to develop new workplace giving opportunities that will boost support for your mission and engagement in the workplace, such as:

- Custom Matching Gift Programs: Many companies offer matching gift programs, where they match donations employees make to eligible nonprofits. If they can’t offer a full-blown donation matching program, recommend a custom program, in which they match employees’ donations to only your nonprofit.

- Payroll Deduction Programs: Nonprofits can partner with companies to set up payroll deduction programs, enabling employees to donate part of their paychecks directly to their chosen nonprofit. This method is convenient for employees and can provide a steady stream of income for your nonprofit.

- Volunteer Grants: Encourage companies to provide volunteer grants, where they donate to nonprofits based on volunteer hours logged by their employees. Collaborate with these companies to track and report these hours to maximize the funding received.

- Workplace Fundraising Events: Your nonprofit can partner with companies to organize workplace fundraising events such as charity runs or bake sales. These events engage employees, foster team-building, and raise money.

- In-Kind Donations: Apart from financial contributions, companies can provide in-kind donations like products, services, or expertise that are valuable to your nonprofit’s operations. They can even launch a drive, such as a toy drive, in which employees contribute.

When executed effectively, these workplace giving opportunities can contribute substantially to your corporate partners’ social impact.

For these partnerships to be successful, you should clearly communicate your nonprofit’s goals, demonstrate potential impact, and maintain transparency in operations. Building strong relationships with companies can lead to long-term support for your cause.

With billions of dollars on the line for the nonprofit sector, your nonprofit has to do whatever possible to boost your corporate gifts. Whether you’re directly empowering donors to submit matching gifts with your software or spreading awareness about corporate giving, you can make the difference between simply achieving your fundraising goal and smashing it!