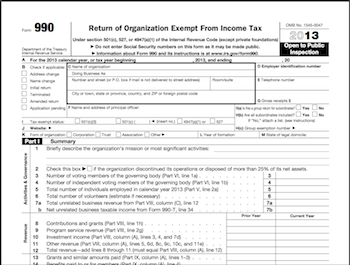

Everyone is gearing up for fundraising and other activities in January. There is a lot on everyone’s plate, and budgets have to be prepared for board approval. Depending on your fiscal year you may also have to complete the IRS 990 Form. It is a tax filing that every nonprofit organization has to complete annually.

Size doesn’t matter

Even if your 501(c) (3) is not a large organization, there is still a requirement to file these tax forms. The deadline for the paperwork is the 15th of the fifth month after an organization’s fiscal year ends. This means that for a non-profit whose fiscal year ends on December 31st the deadline is May 15th of the following year.

While for many organizations there is still some time to the filing, this is not a chore to procrastinate on. The Internal Revenue Service can impose a penalty on a nonprofit organization that either fails to file or provides inaccurate returns. This can be a monetary fine but for a charity just starting up there’s an even worse consequence. The Internal Revenue Service may revoke the tax-exempt status of an organization that fails to file returns for three consecutive years.

File form 990–N or “e-Postcard”

The Internal Revenue Service is not out on a witch hunt. As a matter fact, the government tries to make things as easy as possible for small groups. A nonprofit charity that has gross annual receipts under $50,000 has the option of filing a Form 990–N. This is commonly referred to as a “e-Postcard” and can be filed instead of a Form 990 or Form 990-EZ.

There are only eight very simple questions that have to be answered, including confirmation that gross receipts are under $50,000 for the taxable year. This can be done online which makes things even more convenient. Conversely, making it so simple to file also makes it harder to excuse missing the filing deadline. Claiming ignorance of having to file is not an excuse in the eyes Internal Revenue Service, either.

Filing a 990-EZ

An organization facing a filing deadline will probably want to use the form 990-N if it is applicable. Yet at the same time, a nonprofit organization may want to work on the Form 990-EZ for filing. It can be considered an exercise in better understanding the finances of your nonprofit organization. The 990 forms are also a means for your organization to be evaluated by others.

Gathering information to complete this form may be tedious, but all of the work gives the fiscal officer a very clear picture of where the money is coming from and what is it being spent on. The first time filing of a Form 990-EZ is actually the hardest. Future filings are easier because there is a historical record as well as a routine having been established. All the effort in completing the Form 990-EZ can result in a process by which the young nonprofit compiles and stores its financial information. This can definitely help as time goes on.

State requirements

The Form 990 can be filed electronically and it is free of charge for those organizations that have less than $100,000 in gross receipts. Preparing and filing a Form 990 is not the only tax reporting obligation that a nonprofit charity has to consider.

The states themselves have their own requirements. These can be annual reports, annual financial returns, tax status, or charitable solicitation registration if fundraising activities are occurring within the state. It is important that a 501(c)(3) nonprofit review what is required by the state in which they do business.

A very real benefit

Filing taxes serves another purpose besides the obvious and there are some serious benefits for going through the process: Charity search engines like GuideStar include Form 990 information in their database, which is used by funders or donors looking for organizations. And some foundations that will ask for the tax returns as part of the proposal process.

It will take some time to get started filing the 990 form, but once it becomes standard operating procedure the annual activity becomes easier and easier to do.