It’s no secret that one of the key benefits that comes with registering a 501(c)(3) nonprofit organization is exemption from federal (and most state) income taxes. But just because your nonprofit is tax exempt doesn’t mean you can completely write off tax season!

Due to its status as a registered corporation, association, or foundation, there are several different tax forms your nonprofit has to fill out each year. These documents are essential for complying with legal requirements, ensuring financial transparency and accountability, and fulfilling your organization’s duties to its employees.

In this guide, we’ll review the basics of five tax forms all nonprofit professionals should be familiar with. Let’s dive in!

1. Form 1023

If everything goes according to plan, your nonprofit should only have to complete Form 1023 once—upon its establishment. Form 1023, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is the form your nonprofit’s founders filed with the IRS to secure its tax-exempt status.

To be eligible to file Form 1023, nonprofits first have to:

- File articles of incorporation in the state the organization plans to operate in.

- Develop a set of bylaws and initial policies to govern its work.

- Apply for an Employer Identification Number (EIN).

- Create its first board of directors and submit their names along with the organization’s articles of incorporation.

After the IRS approves Form 1023, most organizations will need to register with their state for charitable solicitation (and potentially for state tax exemption).

Although there is a shortened version available for some eligible nonprofits (Form 1023-EZ), the full Form 1023 is 28 pages long. This is partially why it’s critical to maintain your nonprofit’s tax-exempt status—if you ever lose it, you’ll have to take the time to fill out the entire form again! More importantly, having your 501(c)(3) registration revoked can compromise supporters’ trust in your organization, so keep up with recurring compliance requirements to ensure this doesn’t happen.

2. Form 990

To remain a 501(c)(3) organization, your nonprofit needs to file a federal tax return each year via IRS Form 990. Completing this form correctly demonstrates to the IRS that your nonprofit is legitimate, fiscally transparent, and keeping its promises to reinvest all of its money into the organization—and therefore deserves to stay tax exempt.

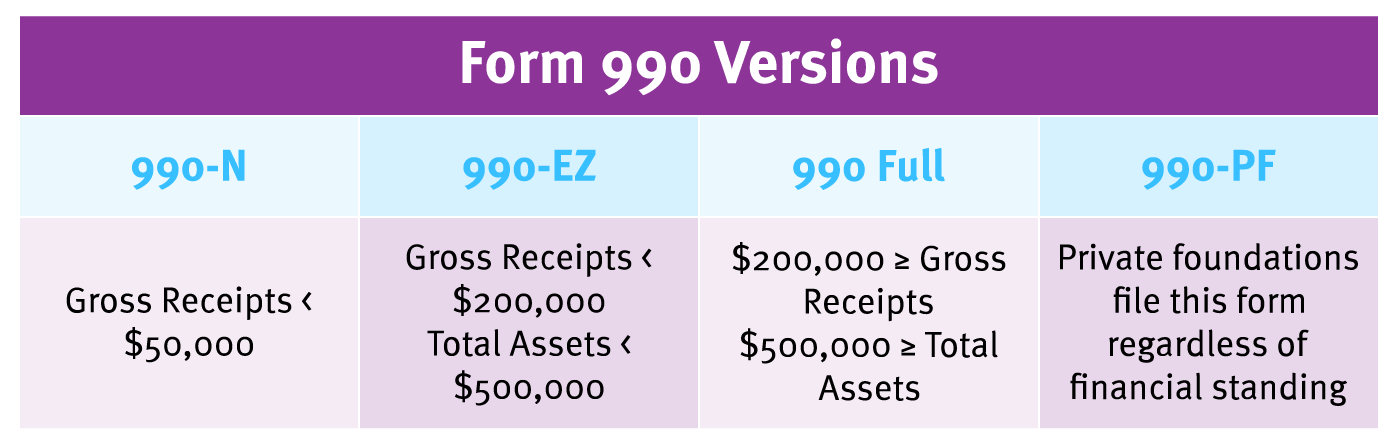

As Jitasa’s Form 990 filing guide explains, there are four versions of this tax form, and which one your nonprofit has to file depends on its annual gross receipts, total asset values, and organization type. The Form 990 variations break down as follows:

- Form 990-N (eight-question digital form): Gross receipts total less than $50,000.

- Form 990-EZ (four pages): Gross receipts total less than $200,000, and total assets are worth less than $500,000.

- Form 990 full (12 pages): Gross receipts total $200,000 or more, or total assets are worth $500,000 or more.

- Form 990-PF (13 pages): All private foundations, regardless of gross receipts or total asset values.

No matter which type of Form 990 your nonprofit completes, the filing deadline is the 15th day of the fifth month after the end of your organization’s fiscal year (May 15 if your fiscal year follows the calendar year). Late filings can incur penalties, and failing to file for three consecutive years will result in your nonprofit losing its 501(c)(3) status. So, plan ahead to ensure you can complete your Form 990 on time!

3. State-Specific Tax Forms

Depending on the state your nonprofit operates in, you may need to file additional forms to maintain state tax exemptions. Two of the best-known nonprofit state income tax forms are Form CHAR500 in New York and Form 199 in California. The rules around sales and property taxes for nonprofits also vary by state—use the state-specific links on the IRS website to stay up-to-date on your organization’s filing requirements.

If your state doesn’t have separate nonprofit income tax forms, your organization may have to provide other proof of financial compliance to remain exempt. For example, some states (such as Georgia and Connecticut) require nonprofits to file a copy of their Form 990 with the state government. Additionally, as DonorSearch’s guide to nonprofit annual reports explains, other states (like Montana and Ohio) ask for a copy of each exempt organization’s annual report, which should contain financial information that the government can use to check for compliance.

4. Form W-2

Along with filing the necessary tax forms for nonprofit compliance, your organization is an employer and therefore is required to report staff members’ compensation to the IRS. This ensures the government has a record of all money your nonprofit has withheld from employees’ paychecks for their income tax and helps them file their annual tax returns.

For each individual employee on your nonprofit’s payroll, you’ll need to complete Form W-2, also known as a Wage and Tax Statement. There are six copies of this form that should all include the same information for different purposes:

- Copy A: Your nonprofit files with the Social Security Administration.

- Copy 1: Your nonprofit files with its state or local tax department.

- Copy B: The employee files with their federal tax return.

- Copy 2: The employee files with their state or local tax return.

- Copy C: The employee keeps for their records.

- Copy D: Your nonprofit keeps for its records.

The deadline for your organization to complete all of its annual W-2s is January 31, regardless of its fiscal year. This includes submitting Copies A and 1 to the correct organizations and issuing Copies B, 2, and C to employees so they can complete their individual returns by April 15.

5. Form 1099

In addition to your nonprofit’s long-term employees, you might also work with contractors temporarily for specific purposes. For example, if your nonprofit wants to redesign its website, you might contract a professional web developer to help you out for a few months and pay them only for that project.

In this case, you’ll likely need to complete Form 1099 (the miscellaneous income tax form) to report your payment to the IRS and ensure they can file their taxes correctly. The conditions for issuing a 1099 include when the recipient of a payment:

- Is not an employee of your nonprofit

- Is an individual, partnership, vendor, or estate (not a corporation)

- Performed services in the course of your organization

- Received at least $600 during one calendar year

To complete Form 1099, you’ll first need to collect key information like the contractor’s address and Taxpayer Identification Number (TIN—either their EIN if you’re contracting from an organization or their Social Security number if the contractor is an individual) via Form W-9. Then, fill in the rest of the information, such as the contractor’s total compensation and the category of payments made, from your nonprofit’s records. The deadline for issuing 1099s is the same as for W-2s, January 31.

Although keeping track of all of these nonprofit tax forms might seem complicated at first, your organization will be able to maintain compliance as long as you stay organized. Use the tips above to get started, and don’t hesitate to reach out to a nonprofit accountant if you have any questions or want a financial expert to file these forms on your organization’s behalf.