In the world of nonprofit fundraising, understanding your supporters is key to driving workplace giving engagement and maximizing impact. One powerful way to do this is by uncovering where these individuals work—a detail that can open the door to corporate giving opportunities, such as matching gifts, volunteer grants, and other employer-sponsored programs. And while you’re likely collecting this information through numerous methods already (donation forms, volunteer registrations, and email domain screening, to name a few), it’s likely that there are still a few gaps in your data. That’s where employer append services come in.

In this quick review, we’ll explore how employer append services work, what to look for in a provider, and why this tool is becoming a must-have for modern nonprofit strategies. Specifically, we’ll cover:

- Understanding Employer Append Services for Nonprofits

- Key Features to Look for in Employer Append Services

- Evaluating Top Employer Append Service Providers

- Implementing Appended Employer Data in Your Fundraising Strategy

These service providers help nonprofits identify their supporters’ employers using donor data they already have. With that insight, organizations can build stronger corporate partnerships, market workplace giving programs more effectively, and ultimately boost their revenue. Let’s begin!

Understanding Employer Append Services for Nonprofits

Employer append services are specialized data enhancement tools that allow nonprofits to enrich their donor databases with employer-related information. This can include the name of the organization where a donor works, their job title, and their workplace giving eligibility. Such information is invaluable for nonprofits, as it helps tailor communication strategies and workplace fundraising efforts to align with the eligibility and corporate giving potential of donors.

Integrating employer data into fundraising efforts can drastically enhance a nonprofit’s ability to connect with its audience. For instance, knowing a donor’s employer allows organizations to identify potential matching gift opportunities, where companies match employee donations to nonprofits. Additionally, many corporations have philanthropic programs that encourage employees to volunteer, which can open up further avenues for engagement and funding. Plus, some donors will even work for companies that offer things like in-kind donations and corporate grants, and may serve as an advocate to their employer on your behalf. But you need to know where they work, first, to uncover these opportunities!

Key Features to Look for in Employer Append Services

When selecting an employer append service provider, it is essential to consider several key features that can enhance the quality and usability of the data provided. This includes:

- Data accuracy: Nonprofits should seek providers that offer regularly updated information to ensure that they are working with the most current employer details. This is particularly important in a rapidly changing job market, where company structures and employee roles can shift frequently. A reliable provider will not only maintain up-to-date records but also employ rigorous data validation processes to minimize errors.

- Ease of use with existing fundraising tools: Appended employment data should be easy to use alongside your existing fundraising systems. Rather than requiring complex integrations, the data should enhance your current workflows, filling in details and centralizing employment information in one place. This allows your team to proactively reference and leverage that data.

- Customer support: Consider the customer support and training offered by the provider. A responsive support team can make a significant difference, especially when navigating new software or troubleshooting issues. Some providers may also offer training sessions or resources to help nonprofits maximize the use of their services, ensuring that organizations can fully leverage the data at their disposal. This kind of support can empower nonprofits to make informed decisions based on the insights gained from the appended data.

- Ability to identify workplace giving insights: Beyond simply appending employment data, a valuable employer append service should help surface actionable workplace giving insights. This includes identifying donors who work for companies with matching gift programs, volunteer grant opportunities, or corporate philanthropy initiatives. Having this information empowers your team to recognize and act on these opportunities more easily, increasing the potential of each donor record.

Not to mention, cost is always a consideration when choosing a service provider. Nonprofits must weigh the value of the employer data against the costs involved. Some providers may offer tiered pricing structures based on the volume of data required, while others may charge a flat fee for access to their services. It’s important for organizations to assess their specific needs and budget constraints to determine which pricing model offers the best return on investment.

Evaluating Top Employer Append Service Providers

Once you’ve decided to use an employer append service to identify where your donors and volunteers work, the next step is choosing the right provider. Two standout options in this space are Double the Donation and NPOInfo.

Both providers are highly regarded for their ability to help nonprofits efficiently and accurately uncover employer information. In the following section, we’ll take a closer look at what each provider offers, how they compare, and what to consider when deciding which service is the best fit for your organization’s needs.

Option #1: Double the Donation

Double the Donation is a powerful employer append service that helps nonprofits drive revenue through corporate philanthropy programs, specifically matching gifts and volunteer grants, payroll giving, sponsorships, and more. By appending employer data to donor profiles, the platform provides valuable insights into which companies offer workplace giving opportunities, enabling nonprofits to engage donors and encourage them to get involved.

With a comprehensive database and seamless integration with donation platforms and CRMs, nonprofits can automate the engagement process, making it easier to maximize the impact of each donation.

Option #2: NPO Info

NPO Info is an employer append service that provides nonprofits with essential data on their donors’ employers, helping them identify potential corporate connections for future outreach. The platform provides insights from a database of companies associated with donors, enabling organizations to better understand their supporters’ professional affiliations.

However, while NPO Info provides workplace giving-related insights, its platform is not as seamlessly integratable, and the data is not as fresh or complete, requiring more manual effort to track and engage donors. This can make the process less efficient for nonprofits, as it involves additional steps to ensure that workplace giving requests are submitted and processed.

Double the Donation vs. NPO Info

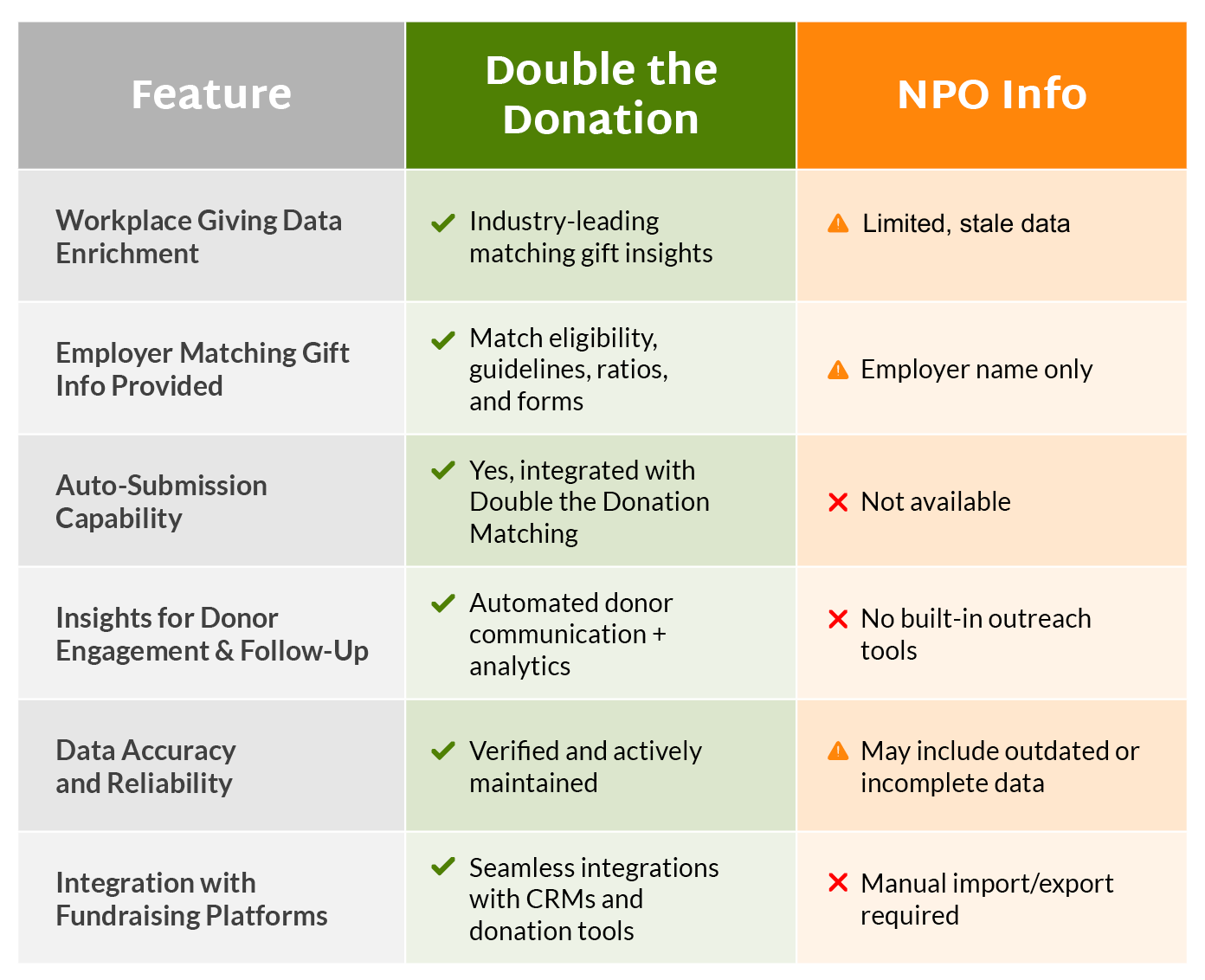

When comparing Double the Donation and NPO Info, nonprofits may find that Double the Donation offers a more streamlined and efficient solution for workplace giving. Double the Donation truly stands out by providing real-time access to a comprehensive database of matching gift and volunteer grant opportunities, seamlessly integrating with donation platforms to automate the process of identifying and processing matching gifts. This reduces manual effort and ensures nonprofits can quickly engage donors, maximizing their fundraising potential with minimal administrative work.

On the other hand, NPO Info provides similar employer append services but lacks the same level of automation and integration, as well as actionable insight into workplace giving opportunities. As a result, nonprofits will likely find it requires more manual input to track and manage corporate giving engagement, and the platform’s less intuitive interface and additional steps in the process may result in a more time-consuming experience.

Overall, Double the Donation offers a more user-friendly and efficient solution, making it the better choice for organizations looking to fully leverage corporate philanthropy with minimal hassle.

Implementing Appended Employer Data in Your Workplace Fundraising Strategy

Appending employer data to donor records can significantly enhance your fundraising strategy by unlocking new opportunities, improving donor engagement, and streamlining your outreach efforts. Here are some key tips for effectively implementing appended employer data into your fundraising efforts.

1. Leverage Employer Data for Workplace Giving Opportunities

One of the most powerful ways to use appended employer data is to identify which of your donors’ employers offer matching gifts, volunteer grants, or payroll giving. By knowing which companies provide support through these types of programs, you can proactively reach out to donors and encourage them to get involved, effectively doubling or tripling the impact of their contributions.

2. Segment Donors Based on Employer Data for Targeted Outreach

With employer data, you can segment your donors based on the companies they work for, allowing for more personalized and targeted corporate giving-related outreach. For example, you could create specific campaigns targeting employees of major corporations known for their generous matching gift programs or volunteer grants. By tailoring your messaging to each segment, you can increase the likelihood of donors taking action, whether it’s submitting matching gifts or volunteer grants, signing up for payroll giving, or increasing their overall support.

3. Enhance Corporate Partnerships and Sponsorships

Appended employer data can also help you identify potential corporate sponsors or partners for your nonprofit. By understanding where clusters of donors work, you can proactively approach companies with targeted sponsorship proposals or partnership opportunities. Alternatively, their company may have already established programs, like in-kind donations or grant opportunities (such as those located in Double the Donation’s database), which can help you target your outreach to those companies and their employees.

If a donor works for a company with a corporate social responsibility program, for example, you can leverage that connection to foster a deeper relationship with both the donor and the company, potentially securing new funding sources or in-kind donations.

4. Increase Donor Engagement with Employer-Specific Resources

Make the most of your appended employer data by providing resources specifically tailored to the companies where your donors work. This might include educational materials on how to submit matching gift requests, as well as detailed instructions on volunteer grant opportunities available through their employer.

By giving donors all the tools they need to take full advantage of workplace giving, you create a more engaging experience that encourages long-term support.

5. Track Corporate Giving Impact and Report Results

Once you begin utilizing appended employer data in your fundraising strategy, it’s important to track the impact of corporate giving initiatives, such as matching gifts, volunteer grants, and payroll giving. Use the data to measure the additional revenue generated through the programs and assess the effectiveness of your outreach efforts.

Reporting these results not only helps you understand the return on investment but also allows you to demonstrate the success of your corporate giving strategy to stakeholders and funders.

Wrapping Up & Additional Employer Append Resources

Employer append services offer nonprofits a practical, data-driven way to tap into the growing world of corporate philanthropy. By identifying where supporters work, organizations can tailor outreach, unlock hidden corporate giving potential, and deepen donor relationships. Whether you’re just getting started with workplace giving or looking to strengthen existing strategies, investing in an employer append service can be a game-changer for your fundraising and volunteer engagement efforts.

Interested in learning more about employer append services and how they can boost your revenue with workplace giving information? Check out these additional resources to get started:

- The Ultimate Guide to Employer Appends for Fundraisers. Take a deep dive into all things employer appends with this comprehensive guide. Learn what employer appends are, how to conduct them, and what you can do with the information you receive.

- How to Navigate Workplace Giving: 5 Ways to Help Your Donors. Raise more for your cause through workplace giving when you make it quick and easy for your donors to participate. Find out how you can streamline the process with the insights here.

- Avoid These 5 Employer Appending Mistakes Nonprofits Make. Don’t let your employer appends go to waste! Learn how you can make the most of your donor records, and avoid common mistakes nonprofits often make, in this helpful resource.